Guarding Your Possessions: Count On Structure Knowledge within your reaches

In today's complicated monetary landscape, ensuring the protection and development of your properties is paramount. Depend on foundations serve as a keystone for safeguarding your riches and legacy, offering an organized strategy to asset security.

Relevance of Trust Fund Structures

Count on foundations play a critical role in developing trustworthiness and cultivating strong connections in various specialist setups. Trust fund foundations offer as the cornerstone for ethical decision-making and clear communication within organizations.

Advantages of Professional Guidance

Building on the foundation of trust in professional partnerships, seeking expert assistance provides indispensable benefits for individuals and organizations alike. Specialist assistance gives a wealth of knowledge and experience that can help browse complicated monetary, legal, or tactical challenges effortlessly. By leveraging the experience of professionals in various areas, people and companies can make informed choices that line up with their objectives and goals.

One significant benefit of professional guidance is the ability to accessibility specialized expertise that may not be conveniently available or else. Experts can supply understandings and perspectives that can lead to ingenious remedies and opportunities for growth. Additionally, dealing with professionals can assist minimize threats and unpredictabilities by supplying a clear roadmap for success.

Moreover, specialist support can conserve time and sources by improving processes and staying clear of pricey errors. trust foundations. Professionals can offer individualized advice tailored to specific requirements, making certain that every decision is knowledgeable and tactical. On the whole, the advantages of expert advice are diverse, making it a useful possession in safeguarding and taking full advantage of possessions for the lengthy term

Ensuring Financial Security

In the world of financial planning, safeguarding a steady and prosperous future depend upon tactical decision-making and sensible financial investment options. Making sure monetary security entails a complex method that includes numerous facets of riches management. One essential component is producing a diversified investment profile customized to specific risk resistance and financial goals. By spreading out investments throughout different possession courses, such as supplies, bonds, real estate, and assets, the risk of considerable economic loss can be mitigated.

In addition, preserving a reserve is essential to secure against unexpected expenditures or revenue disturbances. Specialists recommend reserving three to six months' well worth of living expenditures in a fluid, quickly accessible account. This fund acts as a financial safety internet, providing comfort during stormy times.

Frequently assessing and adjusting monetary plans in reaction to changing conditions is additionally paramount. Life events, market fluctuations, and legislative adjustments can influence economic stability, highlighting the relevance of recurring examination and adjustment in the pursuit of long-term economic safety - trust foundations. By applying these techniques attentively and consistently, people can strengthen their monetary footing and work in the direction of a much more safe future

Safeguarding Your Possessions Efficiently

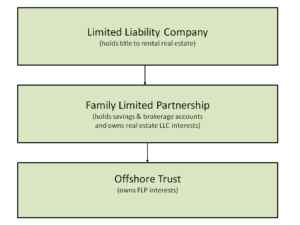

With a solid foundation in place for monetary safety and security through diversification and emergency fund upkeep, the following important step is safeguarding your possessions efficiently. One reliable strategy is property appropriation, which includes spreading your financial investments across different important link property classes to lower risk.

In addition, developing a count on can offer a secure way to secure your possessions for future generations. Counts on can aid you control just how your assets are distributed, reduce inheritance tax, and shield your wealth from lenders. By carrying out these strategies and seeking professional recommendations, you can safeguard your possessions effectively and safeguard your monetary future.

Long-Term Possession Security

To ensure the long-term protection of your riches versus prospective risks and unpredictabilities over time, tactical preparation for long-lasting possession defense is crucial. Long-lasting property security involves implementing procedures to safeguard your properties from various threats such as financial slumps, suits, or unexpected life events. One essential element of long-term property security is establishing a trust, which can offer considerable advantages in securing your possessions from financial institutions and legal disagreements. By moving possession of properties to a depend on, you can shield them from possible threats while still retaining some degree of control over their monitoring and circulation.

Additionally, expanding your financial investment portfolio is an additional crucial method for long-lasting possession defense. By spreading your financial investments throughout different property courses, industries, and geographical areas, you can minimize the effect of market variations on your total wealth. Additionally, routinely examining and upgrading your estate strategy is crucial to make certain that your possessions are secured according to your desires in the lengthy run. By taking a proactive method to lasting possession defense, you can secure your wealth and provide financial protection for on your own and future generations.

Final Thought

In conclusion, trust fund structures play a crucial duty view website in securing assets and guaranteeing financial safety and security. Expert support in establishing and handling depend on structures is crucial for long-term possession security. By using the competence of experts in this field, individuals can effectively secure their assets and prepare for the future with confidence. Trust anchor fund structures provide a solid structure for shielding riches and passing it on to future generations.